XRP Price Prediction: Path to $3 Amid Technical Breakout and Bullish Catalysts

#XRP

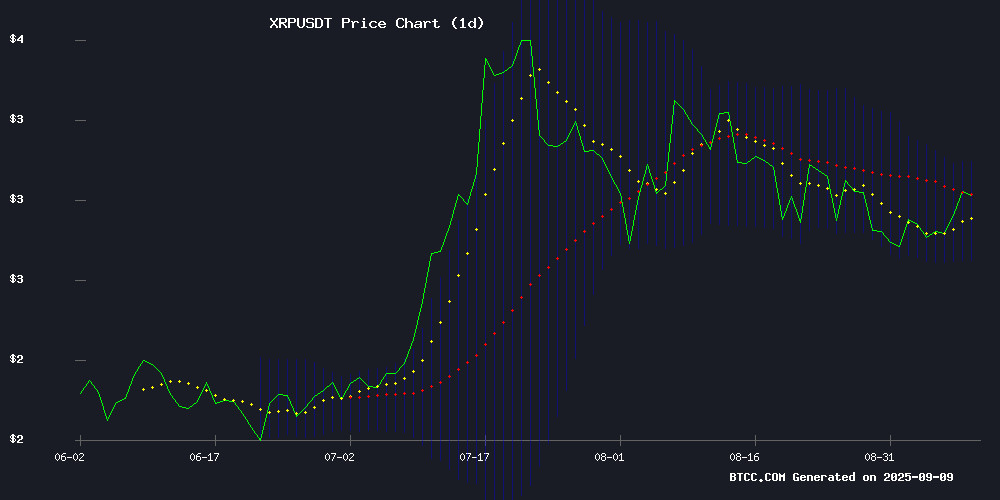

- Technical indicators show XRP approaching key resistance with current price at $2.9586 and upper Bollinger Band at $3.0863

- Fundamental catalysts including Ripple's strategic moves, institutional adoption, and regulatory clarity support bullish momentum

- Market sentiment remains positive with whale accumulation, ETF anticipation, and Fed rate cut speculation driving optimism

XRP Price Prediction

Technical Analysis: XRP Approaches Key Resistance Level

XRP is currently trading at $2.9586, showing bullish momentum as it approaches the critical $3.00 psychological level. The price sits above the 20-day moving average of $2.8955, indicating underlying strength. MACD readings show a slight bearish crossover with the signal line at 0.1084 and MACD at 0.0884, though the negative histogram of -0.0200 suggests potential for near-term consolidation. Bollinger Bands indicate the upper resistance at $3.0863, which could serve as the next target if buying pressure continues.

Market Sentiment: Bullish Catalysts Drive XRP Optimism

Positive fundamental developments are supporting XRP's upward trajectory. Ripple's strategic RLUSD token burn aims to maintain stability, while expanded collaborations with major financial institutions like BBVA enhance custody services. The launch of new XRP futures contracts on BitMEX and growing whale accumulation patterns suggest institutional interest remains strong. Fed rate cut speculation and ETF anticipation are adding additional tailwinds, creating a favorable environment for XRP to test the $3.00 threshold.

Factors Influencing XRP's Price

Ripple Executes Strategic RLUSD Token Burn to Maintain Stability

Ripple has conducted its largest RLUSD stablecoin burn in weeks, removing 2.71 million tokens from circulation on September 9. This follows two 1-million token burns earlier in September, part of Ripple's standard supply management protocol to maintain the 1:1 dollar peg.

RLUSD adoption is gaining momentum, with VivoPower International's Tembo EV subsidiary now accepting the stablecoin for payments. Trading volume surged 88% to $88.51 million, while market capitalization holds steady at $728 million - placing RLUSD among the top 10 stablecoins.

The burns occur when dollars return to Ripple's reserves, with new tokens minted during demand surges. This cyclical process demonstrates Ripple's disciplined approach to stablecoin management as institutional adoption grows.

Ripple’s RLUSD Adoption Fuels XRP Price Speculation Amid Historical Pattern Echoes

Ripple's strategic push for RLUSD stablecoin adoption is amplifying XRP's utility in global payments, with market analysts noting striking similarities to its 2017 bull run. The cryptocurrency currently trades at $3.01, exhibiting momentum that mirrors pre-rally consolidation patterns observed before previous parabolic advances.

Technical analysts highlight a crucial $1.95 support level as the make-or-break threshold for XRP's near-term trajectory. "The current price structure reflects a recurring pattern that often leads to explosive price movements," observed one market technician, drawing parallels to the 2017 surge that saw exponential gains.

Enterprise adoption continues to validate Ripple's infrastructure, with VivoPower's RLUSD integration demonstrating growing institutional confidence. Market participants now watch whether XRP can convert this technical and fundamental alignment into a sustained push toward the psychologically significant $10 level.

BitMEX Launches New XRP Quarterly Futures Contract

BitMEX has expanded its derivatives offerings with a new quarterly futures contract for XRP, dubbed XRPZ25. The product, which began trading on September 9, will expire on December 26, settling against the spot market price at contract close. This follows the earlier XRPU25 contract launched in June, set to mature on September 26.

Futures contracts like these serve as critical tools for institutional and professional traders, enabling hedging and strategic positioning. BitMEX first introduced XRP perpetual futures in 2020, later adding spot trading in March 2024. The latest move underscores the exchange's commitment to broadening its XRP product suite amid growing demand for crypto derivatives.

Ripple's XRP Aims to Disrupt SWIFT as Legal Clouds Clear

Ripple emerges from its protracted SEC battle with renewed focus on challenging SWIFT's dominance in cross-border payments. The XRP ledger promises near-instant settlements at minimal cost, contrasting sharply with SWIFT's legacy infrastructure where 10% of transactions fail and 5% face delays.

CEO Brad Garlinghouse's vision of blockchain-based financial rails gains traction through global partnerships, though widespread banking adoption remains uncertain. The resolution of securities litigation removes a critical barrier to U.S. expansion, potentially accelerating institutional adoption of XRP's payment solutions.

Coinbase Drops Out of the Top 10 Exchanges Holding XRP

Coinbase, a leading U.S.-based cryptocurrency exchange, has seen its XRP reserves plummet by 85% in just over two months, dropping it out of the top 10 exchanges holding the token. The decline, from 884.3 million XRP in June to 132.4 million, has sparked speculation among XRP enthusiasts.

Upbit now leads with 5.871 billion XRP, followed by Binance at 2.822 billion and Uphold at 1.739 billion. The rapid depletion of Coinbase's reserves contrasts sharply with its former position as the fifth-largest holder. No official explanation has been provided for the outflow.

The community continues to monitor the situation closely, with some questioning whether this signals a strategic shift or broader market dynamics at play. Kraken has entered the top 10, holding 185.13 million XRP, while Coinbase's dwindling reserves remain a focal point of discussion.

Analyst Predicts XRP 'Biblical Rally' in Q4 2025 Followed by 90% Collapse

Cryptocurrency analyst JayDee forecasts a dramatic surge for XRP in late 2025, drawing parallels to historical patterns. The digital asset, currently approaching $3, could experience what he describes as a "biblical rally"—a blow-off top scenario where euphoria drives prices to unsustainable levels.

Technical indicators suggest a critical setup. Monthly Stochastic RSI (SRSI) bullish crosses have preceded XRP's most explosive gains, including its 2017 rally to all-time highs. A similar mid-2024 cross allegedly sets the stage for another parabolic move.

History offers a cautionary tale. XRP's 2018 peak at $3.84 was followed by a 90% crash within weeks. JayDee warns this pattern may repeat: "These moves consistently end in devastation for late entrants." The analysis implies traders should monitor momentum while preparing exit strategies.

Chainalysis Expands XRP Ledger Support to Over 260,000 Tokens

Blockchain analytics firm Chainalysis has significantly broadened its monitoring capabilities for the XRP Ledger, now tracking more than 260,000 tokens beyond just XRP. The expansion includes IOUs, multi-purpose tokens, and XRPL-based NFT standard assets, providing institutions and regulators with deeper insights into the ecosystem.

Real-time monitoring through Chainalysis' KYT (Know Your Transaction) tool will enable enhanced compliance and suspicious activity detection. The firm's Reactor investigation tool also gains functionality for tracing transactions and visualizing fund flows across XRPL's growing token landscape.

Ripple Expands Collaboration with BBVA to Enhance Crypto Custody Services

Ripple has deepened its partnership with Spain's Banco Bilbao Vizcaya Argentaria (BBVA), positioning the banking giant to leverage advanced cryptocurrency custody solutions. The move responds to surging institutional demand for secure digital asset management.

The expanded agreement builds on a six-year relationship between the two financial players. Ripple's custody technology will enable BBVA to offer clients enhanced security protocols and broader access to digital asset services—a strategic play in Europe's evolving crypto landscape.

Cassie Craddock, Ripple's European executive, framed the collaboration as part of BBVA's progressive approach to blockchain adoption. The bank first integrated Ripple's payment technology in 2017, establishing early institutional credibility for blockchain-based transactions.

XRP Whale Accumulation Drives Triangle Breakout Amid Surging Volume

XRP's price action reveals institutional conviction as large holders accumulate $630 million worth of tokens since September 3. The cryptocurrency now trades at $2.94 with 174% volume surge to $5.55 billion, breaking through key technical formations.

Whale wallets holding 1B+ XRP expanded positions by 70 million tokens while mid-tier accumulators added 150 million. This buying pressure created a firm floor above $2.85, with 93% of addresses now in profit territory—a potential double-edged sword that could trigger profit-taking at higher levels.

Technical indicators show bullish divergence with RSI stabilizing at 51.90 and MACD histograms improving. Traders eye resistance clusters at $3.01 and $3.40 for confirmation of continued upside.

XRP Wallet Xaman Praised for Swift Action Against NPM Supply Chain Hack

Xaman, a prominent XRP wallet, demonstrated rapid response capabilities following a significant NPM supply chain attack. Ripple CTO David Schwartz confirmed the wallet's security remained intact, safeguarding user assets. The attack exploited compromised JavaScript packages, targeting cryptocurrency wallets by stealthily altering transaction addresses.

Ledger CTO Charles Guillemet advised caution for users without hardware wallets, recommending a temporary pause on on-chain transactions. The incident underscores the persistent vulnerabilities in open-source ecosystems and the critical need for proactive security measures in crypto infrastructure.

XRP Rallies 4% Amid Fed Rate Cut Speculation and ETF Anticipation

XRP surged toward the $3.00 mark, buoyed by a 99% market-implied probability of a Federal Reserve rate cut in September. The digital asset climbed 4% intraday, peaking at $2.995 before consolidating at $2.95. Trading volume spiked to 159.63 million—triple the daily average—underscoring institutional participation.

Support held firm above $2.88, while resistance near $3.00 proved formidable. Whales accumulated 10 million XRP during the breakout, even as exchange reserves hit a 12-month high. Six spot XRP ETF applications pending SEC review in October loom as a structural catalyst.

Technical indicators show neutral-to-bullish momentum, with RSI steady in the mid-50s and MACD hinting at a potential bullish crossover. The market now watches whether macroeconomic tides and regulatory decisions can propel XRP past its $3.00 ceiling.

Will XRP Price Hit 3?

Based on current technical indicators and market sentiment, XRP has a strong probability of reaching $3.00 in the near term. The price is currently at $2.9586, just 1.4% away from this key level. Technical support from the 20-day MA at $2.8955 and bullish Bollinger Band positioning suggest underlying strength. Fundamental catalysts including institutional adoption, strategic token burns, and positive regulatory developments create a conducive environment for this move.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $2.9586 | 1.4% from $3 target |

| 20-Day MA | $2.8955 | Support level |

| Bollinger Upper | $3.0863 | Next resistance |

| MACD Histogram | -0.0200 | Potential consolidation |